Misconceptions regarding cryptocurrencies as an alternative to fiat

Caveat emptor.

I think the idea of cryptocurrencies, especially bitcoin, is a beautiful thing. The concept of a decentralized, ledgerized blockchain currency, with limited and capped circulation (for Bitcoin; others like Ethereum are not), really is a novel and revolutionary idea that elegantly solves multiple problems plaguing fiat currencies: high inflation and declining purchasing power caused by infinite monetary printing, the risk of asset seizure by government, the ease of counterfeiting, cumbersome and time-delayed transmissibility, and the risk of the USD eventually losing reserve currency status.

It also solves a number of problems that plague gold and silver, which have been the historical alternative to fiat1: safety issues in storage and transportation (risk of theft and loss due to fire or otherwise), their inefficiency as a medium of currency, difficulty with divisibility, and the ever-present dangers of counterfeiting.

Despite these benefits, the argument presented herein is that the entire cryptocurrency space has been corrupted, including Bitcoin. While it is arguably controlled via governmental regulation over fiat on-and-offramps like Coinbase and by shutting down crypto-focused Signature Bank, the establishment has devised a brilliant workaround to the decentralized nature of the space and taken full control over it by creating what is essentially an unregulated central bank:

Tether.

Tether (USDT) is a cryptocurrency stablecoin putatively backed 1:1 with real U.S. dollars; it claims that each tether it prints is tied dollar-for-dollar to real currencies in its bank account or otherwise.

Tether was launched by the company Tether Limited Inc. in 2014. Tether Limited is owned by Hong Kong-based company iFinex Inc., which also owns the Bitfinex exchange. It was created as a workaround to laws governing the use of dollars in international transactions and is both unregulated and has never passed an audit.2

Tether has a current market cap of $83 billion, and has consistently had more daily trading volume than the rest of the top 10 cryptocurrencies combined. Tether, a 13 man company based in the Virgin Isles, claims to have the #5 cash balance in world:

Apple $202B (audited)

Google $169B (audited)

Microsoft $132B (audited)

Amazon $86B (audited)

Tether $83B (not audited)

General Electric $67B (audited)

In May 2021, Tether published a still-unaudited report showing that 2.9% of Tether was backed by fiat USD, with over 49.6% backed by commercial paper, and the remaining amount backed by other assets. The commercial paper market is a small market, though, and commercial paper traders had not heard of Tether’s commercial paper holdings despite Tether purportedly holding tens of billions of dollars of it. Tether itself refused to disclose whose commercial paper it was holding. Later Tether claimed to have reduced their commercial paper holdings. Previously, Tether Limited as of 2017 stated that owners of tethers have no contractual right, other legal claims, or guarantee that tethers can be redeemed or exchanged for dollars.

So what is the argument?

The contention herein is that most Tethers are unbacked, i.e. they have been printed out of thin air and then used to pump up or contract the cryptocurrency market cap at will; that the owners of Tether have done this for many years; and that the reason they have not been shut down or arrested by the authorities in the years since (despite a small, very lame 2019 New York Attorney General case; and despite multiple Tether affiliates going bankrupt and being criminally charged like the head of Crypto Capital Corp., the CFO of Celsius and Sam Bankman-Fried) is because they were either created or are fully sponsored by the CIA and NSA (and possibly the FBI). They possess what Rolo Slavsky calls a “krisha”, which is institutional protection. There is no other explanation that makes sense why Tether is still operational today.

These federal organizations likely use cryptocurrency for personal enrichment and for money laundering for their black operations. The core reason, however, and why they likely have had broad establishment support for this operation, must be because of this: to publicly stress-test blockchain technologies before central bank digital currencies (CBDCs) are unleashed by governments, which will result in the greatest centralization and loss of individual freedom in human history.

For a deep-dive into Tether, see this 2019 deep dive by Patrick McKenzie, a software entrepreneur who worked for Stripe, who argues “Tether is the internal accounting system for the largest fraud since Madoff.” He followed up and doubled down in a November 2022 update. These articles are well researched and well argued, and very convincing. Revolver News also has an excellent analysis of Tether, calling it “FTX on Steroids”, as does Seeking Alpha. For daily updates on Tether, Bitfinexed on Twitter is a good resource.

See also this 2020 academic study by John M. Griffin and Amin Shams, who concluded:

By mapping the blockchains of Bitcoin and Tether, we are able to establish that one large player on Bitfinex uses Tether to purchase large amounts of Bitcoin when prices are falling and following the printing of Tether. Such price supporting activities are successful as Bitcoin prices rise following the periods of intervention. Indeed, even 1% of the times with extreme exchange of Tether for Bitcoin have substantial aggregate price effects. The buying of Bitcoin with Tether also occurs more aggressively right below salient round-number price thresholds where the price support might be most effective. Negative EOM price pressure on Bitcoin in months with large Tether issuance points to a month-end need for dollar reserves for Tether, consistent with partial reserve backing. Our results are most consistent with the supply-driven hypothesis.

Overall, our findings provide support for the view that price manipulation can have substantial distortive effects in cryptocurrencies. Prices in this market reflect much more than standard supply/demand and fundamental news. These distortive effects, when unwound, could have a considerable negative impact on cryptocurrency prices. More broadly, these findings also suggest that innovative technologies designed to bypass traditional banking systems have not eliminated the need for external surveillance, monitoring, and a regulatory framework as many in the cryptocurrency space had believed. Our findings support the historical view that dubious activities are associated with bubbles and can contribute to further price distortions.

These findings, to be fair, have been challenged by others, who have unknown financial incentives for their work.

Many sophisticated parties in the cryptocurrency space likely know and knew what Tether is and what it represents, but they have stayed quiet about it because they don’t want to ruin the primary driver of the industry’s price appreciation. And the masses don’t care; per Gustave Le Bon, “The masses have never thirsted after truth. Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusions is always their victim.” The masses want and desire new, shiny, exciting narratives to fulfill the emptiness in their lives, and how dare the naysayers say otherwise! “Isn’t the feeling amazing when you have an adrenaline pump from investing in shitcoins with your online friends and watching prices double, triple, 10x in rapid succession! Wow, amazing! Let’s laugh at the ‘nocoiners’! What’s the next novelty - NFTs? So cool!”

The Sam Bankman-Fried FTX blowup, which excited the internet and talking heads for months, is minuscule compared to the size and scope of the Tether fraud.

If this contention is accurate, what the establishment’s control over the cryptocurrency space via Tether means is that they can pump or crash the entire crypto space at will. Although the total cryptocurrency market cap is currently over $1.1 trillion, the trading platforms are so illiquid that small amounts of purchases or sales can move the market and cause dramatic, oversized changes in market cap. They can pump prices 100x from here it crash it to near 0; but the decision is entirely theirs, artificially and not subject to market forces.

Globohomo now has the information they need for their CBDCs, which will be rolled out very soon. The CIA, NSA (and maybe the FBI) likely want to continue funding their black ops with crypto and continue their personal enrichment, but really, it’s impossible to know what their plans are for the space from the outside. So far it looks like they’ve been content with slowly deflating their massive fraud-bubble to minimize media scrutiny (BTC is currently at $27,000 when the peak was $65,000); one can imagine the story the Tether creators could tell if the whole thing collapsed and they risked imprisonment, and perhaps globohomo doesn’t want to just kill them off (or the Tether owners are smart enough to use dead-man switches).

Investment in cryptocurrency, then, is basically a risky bet surrounding globohomo’s plans without the insider knowledge necessary to turn the bet into a sure thing. It’s a sad thing, because the decentralized, transparent idea behind Bitcoin itself really is beautiful. But like everything else beautiful in this fallen world, incredible things one way or another seem to always get dragged down into the mud.

Gold and silver

That’s not to say that gold and silver are a panacea either. The establishment has suppressed their prices for decades via COMEX (and also via investment vehicles such as SLV) so the public does not view it as a real alternative to fiat; banks acting on their behalf have been regularly fined for price manipulation/suppression (examples here and here; interesting surrounding information on a dismissed antitrust lawsuit here).

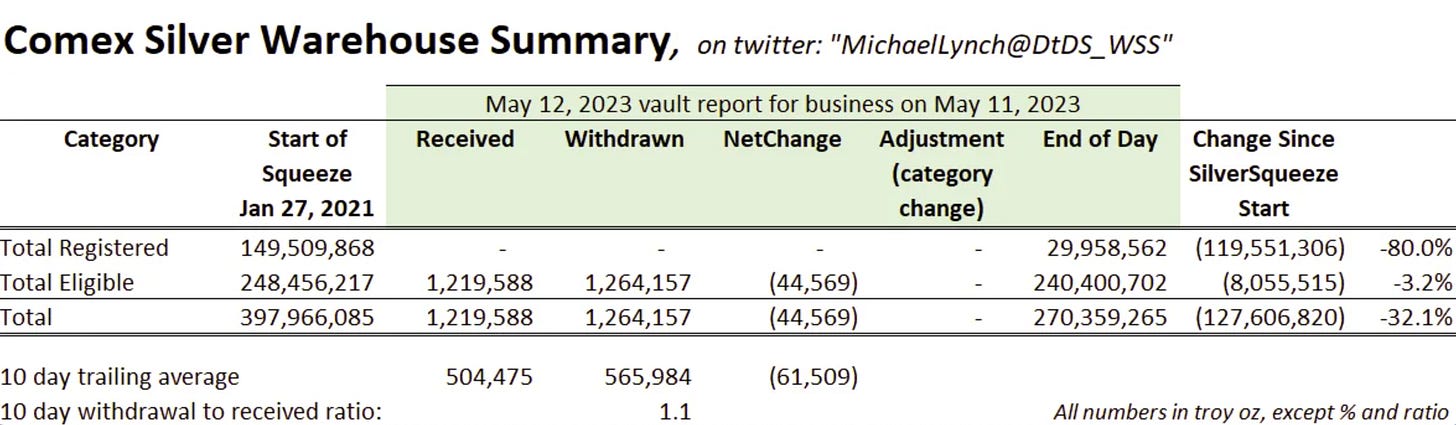

But the silver and gold COMEX vaults have been quietly drained over the past couple of years, down over 32% and 41%, respectively, since January 2021:

It will be interesting to see how prices change as the COMEX vaults continue to drain. Ditch the Deep State on Reddit is an excellent resource to follow for daily updates.

There’s also an interesting argument that, compared to ancient times, silver is dramatically undervalued, comparing an interesting metric: the price of prostitution in silver from that period to the cost of it today.

On the other hand, the establishment could always make gold and silver ownership illegal like they did in the 1930s with Executive Order 6102, or try to crash the (silver) market like they did in 1980 with the Hunt Brothers, but attempts to crash the market would likely be met by other nations (both central banks and citizens) dramatically increasing their bullion holdings.

Ultimately, there’s no panacea with this stuff. Alternatives to fiat carry their own opportunities and risks, and one should do their own due diligence and do a gut check to arrive at a level of investment comfort that comports to their own worldview. But the story on cryptocurrency and Tether hasn’t been properly understood, and hopefully this post is helpful when making your investment decisions.

“Gold Is Money, Everything Else Is Credit” is attributed to JP Morgan while testifying in front of Congress back in 1912 shortly before his death. Also see what resulted from de-coupling fiat from gold since 1971.

In its enforcement action, per Fortune Magazine, the CFTC said Tether failed to disclose that it held unsecured receivables and non-fiat assets as part of its reserves, and falsely told investors it would undergo routine, professional audits to demonstrate that it maintained “100% reserves at all times.” In fact, Tether reserves weren’t audited, the agency said.

I agree with you, but not because of the Tether issues, which in my opinion are of trivial significance compared to the existential threat posed by central bank digital currency (CBDC).

As you rightly point out, the government could make possession of bullion illegal; however the same is true of cryptocurrency - a point that is almost always ignored by fans of crypto. The authorities do not permit states or individuals to print their own paper currency, so why would anyone expect them to tolerate competition to the CBDCs they are actively developing.

Crypto never quite broke into the mainstream, and if it were decreed illegal, the existing userbase would drop precipitously. In fact, it would be a classic bubble burst: with everyone trying to get out of the market, there would be no bid, and the value would drop to nothing. Unlike tangible assets, crypto has no inherent value whatsoever (it is the ultimate fiat), so it could - and probably would - go all the way to zero.

CBDCs offer governments and international organizations (the IMF recently announced their own global digital currency) hithertofore unimaginable control over the lives and behavior of the public. There's no way those institutions will tolerate competition from grassroots alternatives.

Excellent piece. This is a bit out there, but do you believe this is why LUNA (Terraform Labs) was attacked? To eradicate algorithmic stablecoin competitors?

I agree that gold is manipulated, however the reason for the manipulation is that the American elite know that gold is a superior form of money. Allowing gold to reach its market level would deter investments in the U.S. dollar, causing DXY to crash.

I believe we will see gold prices skyrocket once the derivatives market faces the hard reality of the bullion market, and COMEX reserves evaporate. That is, provided the government doesn't intervene to rescue speculators.