Sprinting Toward 2030's "I Own Nothing" Reality

Housing inflation for new buyers is at least 20-30% per year

Since 2020, the cost of new homeownership in the U.S. has risen by at least 20-30% annually. While official figures show modest overall inflation, the real price increases are far higher than that and felt most acutely in housing, with home prices climbing by 50% and mortgage payments more than doubling for new buyers due to soaring interest rates. This post explores the main factors driving this surge, including supply shortages, rising construction costs, and the impact of government policies.

I have made the claim at various points that the real annual inflation is currently at least 20% in the United States, even though the official rate of inflation was only 2.9% in 2024. By real inflation, I’m referring to the rising costs of housing, food, healthcare, insurance (both home and auto), cars, education, and utilities. Some categories have seen slower or even negative inflation such as televisions, internet, and phones (see here from 20181). Official statistics are manipulated downwards to a comical degree for political reasons.

When I tell people my estimate of real inflation rates most people look back blankly, unable to process what I said; I’m not sure if they think I’m joking or if I’ve glitched out their brain. Without an “expert” on television or in writing telling them that real inflation is massive, are most people going to process what’s in front of their eyes?2 Hell, a sandwich eating out is now $15-20! A typical sit-down dinner is $40/person and a steak dinner is $100+/person, at least in urban areas. This is double what it was pre-COVID. Do people even notice how fast prices are changing?

In this post, I’ll focus on one specific aspect: homeownership inflation. This builds on earlier discussions about our shift into a neoliberal feudal system, where the concept of 'owning nothing and being happy' is becoming a reality thanks to the elites driving us toward Agenda 2030. For context, check out this archived Forbes article (they later deleted it) titled Welcome To 2030: I Own Nothing, Have No Privacy, and Life Has Never Been Better. It begins with: “Welcome to the year 2030. Welcome to my city—or should I say, "our city." I don’t own anything. I don’t own a car, a house, any appliances, or clothes.” This reflects a vision of techno-communism where everything is owned by the elites. For a deeper dive into these topics, you can also explore posts like The Wagecuck as the Antithesis of Both FIRE and NEET and The Era of Empty, Secular Mass Consumption Is Over.

The key discussion point for this post is that the cost of homeownership has surged since 2020 despite 30-year fixed mortgage rates rising from 2.5% to 7%. This is highly unusual because typically there’s a strong and direct inverse relationship between interest rates and asset prices - i.e. lower rates allow people to borrow more, which drives prices up, while higher rates reduce borrowing power and lower prices. We will explore why this relationship is not tracking for homes now.

According to the Federal Housing Finance Agency (FHFA), the average purchase price in the United States went from $300,000 in 2020 to $450,000 through the end of 2024:

The FHFA House Price Index (HPI) focuses on changes in the price of single-family homes based on actual sales transactions. The HPI tracks price changes over time in specific geographic regions, adjusting for factors like home characteristics (e.g., size, location, etc.) to ensure it reflects only price changes, not shifts in the types of homes being sold. A 50% increase in 4 years equals 12.5% price appreciation/year.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index also shows a corresponding roughly 50% rise in cost from 2020. While the FHFA HPI index is meant to track dollar-for-dollar, the Case-Schiller HPI shows relative price changes over time but doesn't directly provide the price of homes in dollars:

Meanwhile, 30 year mortgage rates have increased from a low of 2.5-3% in 2021-2022 to 6.95% today:

A monthly payment at 6.95% is about 64% higher than it would be at 2.70% for a 30-year fixed mortgage at the same home price.

A 50% increase in the home price and a 6.95% interest rate compared to the original 2.70% interest rate leads to a monthly mortgage payment that is more than double the original payment at approximately 146.2% higher. Divide by 4 years and that’s a 36.55% increase in the cost of mortgage payments or divide by 5 years and it’s a 29.22% increase. Another way of looking at it is house payments as a percentage of median income:

That 2024 rate is higher now as interest rates today are higher. Or see:

And:

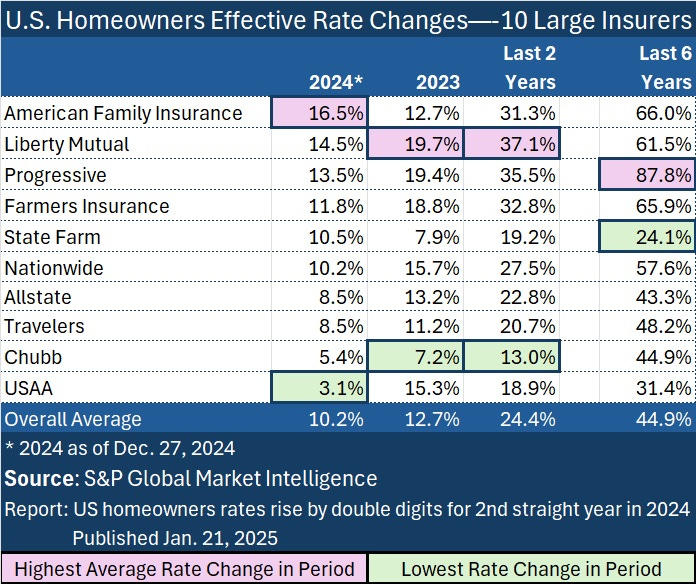

Of course the cost of home ownership includes other things such as property taxes, homeowners insurance, maintenance, and utilities. These costs have also surged massively (50%~ over the past five years?), but they are also location dependent.

Homeowners insurance rates are up 44% nationally over the past 6 years:

I think I’ve built a decent case here for how the cost of home ownership has increased at least 20%, if not much more, year-over-year since COVID.

Now, why have home prices increased so much since 2020 even though interest rates have tripled? As I wrote above, it is a highly unusual situation. I attribute it to the following factors:

a massive increase in national debt to $37 trillion, massive monetary expansion ($11 trillion alone was printed during COVID) and a continuously running $2+ trillion dollar deficit dramatically decreases the value of the dollar versus hard assets;

an estimated 20 million illegal immigrants were let into the country under the Biden administration, straining housing resources;

the lack of new construction during COVID and its aftermath which disrupted the housing supply chain;

the impact of COVID on the global supply chain caused sharp increases in construction material prices—lumber, steel, copper, and even appliances became more expensive;

Builders have faced continued challenges such as labor shortages, rising material costs e.g. lumber, steel, and supply chain disruptions;

a shift in housing preferences with the increase in remote work;

institutional investors have been increasingly buying single-family homes as part of larger portfolios, turning them into rental properties (this practice should be illegal in my opinion). Recent research by MetLife Investment Management (MIM) estimated that institutions own some 700,000 single-family rentals in 2022, about 5% of the 14 million SFRs nationally. MIM forecasts that by 2030 institutions will increase SFR holdings to 7.6 million homes, more than 40% of all SFRs; and

the lock-in effect from existing homeowners who don't want to trade their low-rate mortgages for higher ones.

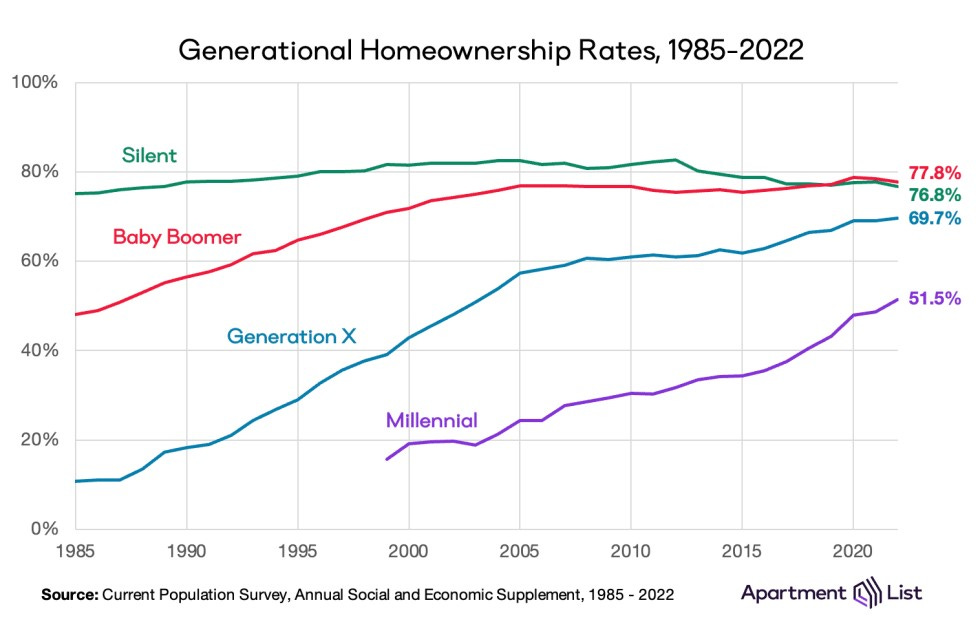

While homeownership rates are not terrible by historical standards, generational home ownership rates are horrific - i.e. the silent and baby boomer generations are doing great, while Gen X is somewhere in between and Millennial home ownership rates are terrible. Let’s not get started about Gen Z.

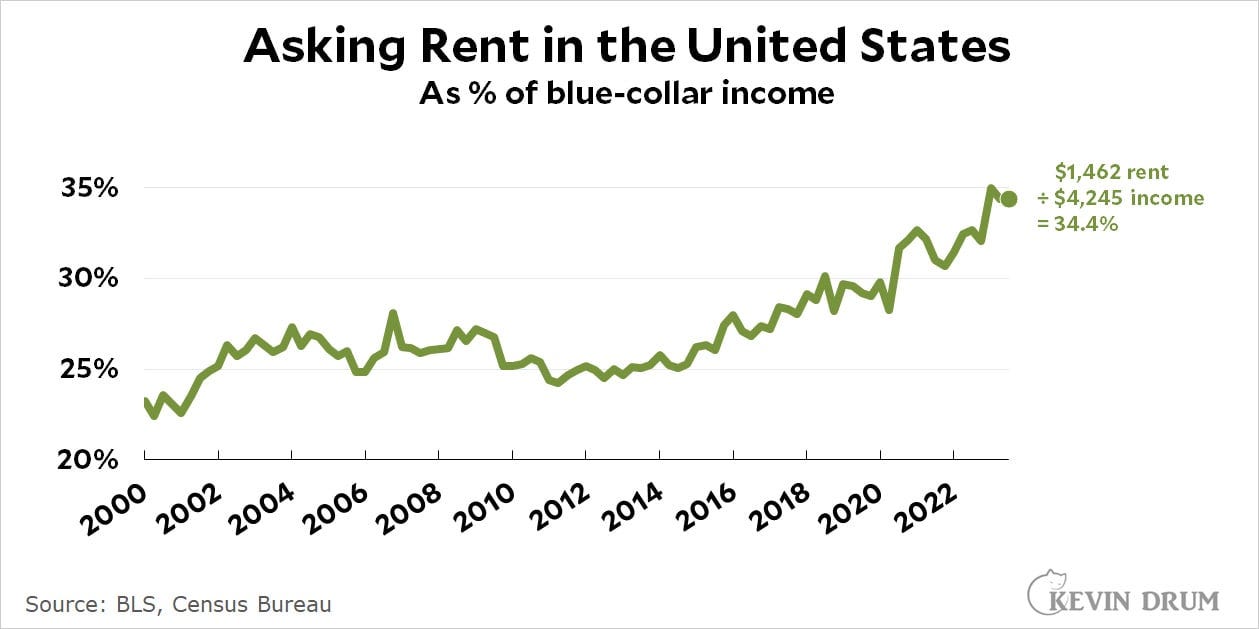

If you don’t own a home is the cost of renting to going to be much cheaper? No, that’s gone way up too:

The average cost of rent is rising far faster than rising incomes:

So, look. As I’ve argued, the middle class in America is not dying but simply dead at this point. Home unaffordability is extremely high and people have to put an increasingly enormous percentage of their take-home pay toward rent. I believe this to be intentional and engineered, where our upper elites use the magic of financial engineering to lead us toward predetermined results (which they’ve always done historically; see the engineered 1929 crash (as explained by congressman Louis T. McFadden), or the engineered stock market crash in Japan, or how they engineered the rise of Nazi Germany for it’s future destruction). They’ve locked in a lot of people with low interest rates from 2020-2021 which provides an element of loyalty to the regime as they completely screw over younger and future generations.

In 2016 the WEF issued eight predictions for which the future would look like by 2030, which are rapidly coming true (they later deleted the post because it made them look bad, but it is still archived - for now). These predictions include:

All products will have become services. “I don't own anything. I don't own a car. I don't own a house. I don't own any appliances or any clothes,” writes Danish MP Ida Auken. Shopping is a distant memory in the city of 2030, whose inhabitants have cracked clean energy and borrow what they need on demand. It sounds utopian, until she mentions that her every move is tracked and outside the city live swathes of discontents, the ultimate depiction of a society split in two.

US dominance is over. We have a handful of global powers. Nation states will have staged a comeback, writes Robert Muggah, Research Director at the Igarapé Institute. Instead of a single force, a handful of countries – the U.S., Russia, China, Germany, India and Japan chief among them – show semi-imperial tendencies. However, at the same time, the role of the state is threatened by trends including the rise of cities and the spread of online identities,

Today’s Syrian refugees, 2030’s CEOs. Highly educated Syrian refugees will have come of age by 2030, making the case for the economic integration of those who have been forced to flee conflict. The world needs to be better prepared for populations on the move, writes Lorna Solis, Founder and CEO of the NGO Blue Rose Compass, as climate change will have displaced 1 billion people.

The values that built the West will have been tested to breaking point. We forget the checks and balances that bolster our democracies at our peril, writes Kenneth Roth, Executive Director of Human Rights Watch.

It’s easy to make predictions for the future when one is deliberately conspiring to carry them out.

If you want to understand what the end goals of our elites are, see this three part series here. For the structure of the modern world, see here. Basically, our upper elites are intentionally re-instituting a permanent neoliberal feudalism which they hope will last forever. Or as a prescient 4chan poster wrote in 2013:

This process will be supercharged by upcoming central bank digital currencies, which will result in the greatest loss of personal freedom in human history.3

I hope you “enjoyed” this foray into real rates of inflation. But if you believed the official rates of inflation of 2-3% were anywhere close to reality prior to reading this post, then you’re probably beyond saving at this point.

Thanks for reading.

PS: One asset class that I think remains undervalued - perhaps the only one in this market - is gold and silver. While gold just hit a new all time high at $2,900~/oz, it’s current real value is estimated at $9,000-12,000/oz per the U.S. Debt Clock website (scroll to the far right and a little down). Silver's value is $1,100-1,500/oz. The biggest difference between bullion and crypto is that gold and silver prices are actively suppressed by the government while crypto prices are massively inflated via the Tether scam, which is not an insignificant factor for consideration…

Car inflation was fairly nominal through the date of the article (2018), but experienced significant price increases during COVID.

As explained here, “Before criticizing the masses for failing to investigate and organize societal trends in their own minds, let’s first ask if the masses have frequent inner thoughts. The concept is strange, but the answer may be less than one would expect according to a 2007 University of Nevada Department of Psychology study on college students. Per the study, regarding the frequency of common phenomena of inner experience (inner speech, inner seeing (aka images), unsymbolized thinking, feeling, and sensory awareness), the frequency of common phenomena of inner experience is low, with 13-30% of participants not experiencing any specific form of inner experience during the study:

If this is accurate, many people may lack specific types of inner experience, and the overall frequency of some types of inner experience may be surprisingly low. Perhaps the low frequency of inner speech (17% not experiencing it at all, and the overall frequency being 26%) explains the nature of extraverts, or why many women verbalize what they feel to those around them as a running commentary. Regarding unsymbolized thinking, defined as “thinking a particular, definite thought without the awareness of that thought’s being conveyed in words, images, or any other symbols”, the overall frequency was only 22% with 30% of participants not experiencing it at all. A lack of frequent unsymbolized thinking may explain why so many people live paycheck-to-paycheck with no ability to plan for expenses. The premium for car insurance isn’t an event that’s planned for, it’s just something that happens; if a person has the money great, if not they’ll deal with it when the bill comes in. It’s why people living on food stamps eat steak, buy expensive hardbacks and then run out of money before the month ends. The idea that the person will need to eat at the end of the month just like they did last month doesn’t cross their minds.”

The head of the Bank for International Settlements, Agustin Carstens, brags about what is coming soon with their micromanaged CBDC control grid and dramatically decreasing quality of life for most:

Catherine Austin Fitts of the

delves into what this means here; one may note that the $500 billion “investment” into Stargate Data Centers and Musk’s recent DOGE moves at the Treasury, stupidly cheered on by the retarded Trumpenproleteriat, are facilitating this process.

This is why I'm building my house myself. My cost in materials is about half the current median price. No debt.

Building houses yourself used to be much more common. With modern tools and access to information it is easier than ever. Just a classic mix of risk and hard work.

https://youtube.com/@erik_mn

Nice overview of the situation. I agree with your assessment of the factors driving home price inflation, and the way it ties into the overall movement towards neofeudalism. If you're interested in looking outside the largely fraudulent Keynesian economic theories that they teach in school (e.g., the proposition that "typically there’s a strong and direct inverse relationship between interest rates and asset prices" is demonstrably false, but it gets repeated and taught as accepted wisdom anyway), I recommend checking out the work of Martin Armstrong. https://armstrongeconomics.com/blog