Wealthy boomers and wage earners, regardless of political affiliation are beginning to express panic amid a drop in the stock market. This reaction highlights the "Numbers Go Up" mindset, where stock market performance is seen as the sole indicator of societal health despite real-world issues like inflation and social decay. This article critiques this unhealthy obsession, noting how panic from a continued drop in the market will be exploited by the elites for their own purposes.

On Thursday, April 3, when the S&P 500 declined 4.84% (before Friday’s 5.97% fall), a friend told me that his wealthy boomer boss, a Republican, was flipping out about the stock market and wants Trump thrown out. He heard his boss talking to another Trump voting boomer on the phone, and his boss said “I think if the election was held today I don’t think there’s a single person in the country who would vote for him.” My friend has investments in the market which are down but he laughed hearing this.

Another Trump voter I know is depressed and wishes Kamala won. A successful far-leftist I know felt emboldened enough to rant about Trump (he and other leftists have been on zombie-idle mode since the election, turned off by the media machine) and another successful far-leftist warned that the Trump hate will return with a vengeance if the market keeps falling.

This all for a market that had fallen only to September 2024 levels!

This made me think about the magical nature of numbers, which I will return to in a second.

But first, for newer readers, my position is a nuanced one: I supported Trump during 2015-2016 as he gave a voice to the forgotten white Middle American whose jobs had been shipped overseas and who had been constantly discriminated against in media, in work, in schooling and universities, and I have continued to support him, more and more reluctantly, until I came to understand he was allowed to win the 2024 election only because he came to backroom deals with the elites to give them whatever they wanted - unlimited Israel support, no Epstein files released, no real JFK files release, unlimited corruption and graft allowed, no one punished for fraudvirus or the Russiagate scam, etc. The solid political figure Ian Smith (who I covered previously) delves into the details of Trump’s betrayal in this strong Twitter rant, but I also have posts on it here and here. Because Trump has so rapidly betrayed his base since he won, his approval is slipping into the gutter (which, to be fair, also happens to other presidents - such as to Biden and Trump 1.0 - after they won their elections):

I do expect Trump’s support to fall off a cliff if there is a large and sustained market crash, but some 5D chess types are arguing Trump is intentionally causing chaos in order to force interest rates to decline so that all these tech and other companies can refinance their enormous, earth-shattering debt levels at lower rates, after which Trump will stop the tariff chaos and the market will boom again. Personally I don’t believe Trump is capable of 1D chess at this point, let alone 5D chess.

Numbers Go Up

The Numbers Go Up hypothesis is that there are certain converging factors that have coalesced into a belief by the wealthy that everything is ultimately fine so long as the stock market keeps improving in a straight line up forever. Every other aspect of life and of the economy can be ignored so long as Numbers Go Up - there’s no community trust anymore, no job opportunities, no middle class, enormous inflation (20-30% per year due to $11 trillion printed during fraudvirus with most of it given to the upper elites), huge crime which goes unreported and unpunished (why report it? charges won't be brought anyway), a destroyed environment, crashing fertility rates, everyone depressed and medicated. But who cares if Numbers Go Up? It’s almost comical to the point that if you stuck a rich boomer in a post-Hiroshima environment, a totally blown out and destroyed world, if you gave him a pile of money he’d be happy — well, at least until he had to eat or sleep, after which he’d have to burn the pile of money for warmth. It apparently burns very nicely.

Under the theory of Stock Market Numbers Go Up, the bourgeoisie - upper and upper middle class boomers at this point, as they have most of the country’s wealth - pretend to care about other issues, but at the end of the day what they really care about is when Stock Market Numbers Go Down. As long as Numbers Go Up, they are satiated, satisfied, regardless of any and every other factor of life; if Numbers Go Down, all hell breaks loose.

Most people consciously think they care about certain things, but careful observation of their actions shows something entirely different: what causes them panic, what actually motivates them into action, show that their actual deep, core beliefs have little to nothing about what they say they care about when times are easy and good. This was easy to see during fraudvirus, where a huge number of seemingly small government minded Republicans and libertarians became authoritarian Big Daddy government types overnight, or how far-leftists who claim to care about economic populism passionately despised far-right “alt-right” types, as they ultimately care about anti-white egalitarianism more than economic populism. What people ultimately care about comes out in times of stress, not when times are good. The Numbers Go Up focus is also indicative of broader issues: the secularization and commodification of society so that every aspect of this reality is reduced to digits on a screen (Rene Guenon’s solidification of the world), the whig belief of history-as-progress (from the benighted past to the glorious future), and the greedy Faustian spirit of ever-overcoming.

Victims of the Process

I do understand and empathize that the remnants of the middle class rely on fixed pensions which are affected by the stock market in order to survive; however, one may note that for all of human history the elderly relied on younger generations to support them in their advanced age as part of a healthy and intact family unit instead of the blown out atomized hellscape we live in today. The Numbers are a lousy substitute for intact family dynamics. How is that computed in GDP growth? Numbers Go Up is also part of an infinite growth Ponzi scheme which requires ever-increasing populations - which means massive unlimited immigration, fundamentally transforming the country, given younger people are not having many children - to support the aging populations.

I also have empathy for the lower and middle classes whose jobs may be in jeopardy if the market decline is sustained (they won’t be affected directly by a market crash as they have no investments and no savings). Tariffs - which is the official but false excuse for Numbers Go Down (the elites simply determine if or when to crash the market, as they did in 19291) - could increase prices for goods which may negatively impact the lower and middle classes, although the overall effect is unclear; tariffs may theoretically bring more jobs back to America and lead to upward wage pressure.

The Problem With The Numbers

People may think that the stock market is indicative of the health of broader society, but this is a joke; the stock market has gone up since the 2008 financial crisis solely due to unlimited Federal Reserve monetary printing, and all the released economic numbers are manipulated (unemployment, GDP, inflation, etc. - adjustments are common for political reasons, such as this October 2023 example: Massive Adjustments to Health Insurance CPI "has now caused the year-to-year health insurance CPI to COLLAPSE by 37.3%, despite widespread and big price increases of health insurance"). This is why the economy feels zombified and why there is very little competition among megacorps, who have focused on widening and deepening their monopoly moats (techno-feudalism) which is allowed because they play ball in ultra-corrupt public-private partnerships, along with endless stock buyback programs (having nothing else to do with the money other than line the pockets of their executives).

Even though the stock market has been the highest it’s ever been, the average person is being crushed under the weight of inflation - food inflation, healthcare inflation, rent inflation - and most people have no savings whatsoever. We have reverted to a neoliberal feudalism system with no middle class and we’re supposed to believe the economy is healthy because The Numbers say so? This is like “believe the experts”, “trust the science” and “trust the establishment news” - empty slogans meant as propaganda to fool the masses into accepting their own fleecing. As

argues, this is a period of generalized decline. He quotes the author James Blish:In such a period, politics becomes an arena of competing generals and plutocrats, under a dummy ruler chosen for low intelligence and complete moral plasticity, who amuses himself and keeps the masses distracted from their troubles with bread, circuses, and brushfire wars. (This is the time of all times when a culture should unite–and the time when such a thing has become impossible.)

As a poster wrote on Autoadmit back in 2024:

High inflation outstripping most people's income gains.

Strange abandonment of the 1st amendment, embracing censorship in the name of social good despite being the origin of a great deal of misinformation.

Divisive social engineering techniques, including the open border disaster. American school districts and municipalities are now burdened with the high costs of accommodating the migrants.

Open judicial warfares on people deemed the opposition. See Trump prosecutions in New York, delegitimizing the legal system and undermining confidence in neutrality of American courts.

Entanglement in Ukraine, including allowing it to happen in the first place, and pouring hundreds of billions into an endless quagmire while can't muster a decent response to hurricanes in the US alone.

The list goes on. Look, I'm well off, I'm substantially richer today than I was four years ago. But it doesn't mean I still don't think we've veered off into a damaging direction under the Biden administration, or rather, whoever is running the show in the name of Joe Biden. It's not just economics. It's more than the stock market.

And as Zman wrote here about the Numbers:

This is the problem with conservatism. Who decides that something is too important to be subject to the numbers? There are only two choices. Either a supernatural force like God decides or the people through time and experience decide what is no longer subject to the numbers. The former requires a strong religious foundation for society and the latter is just democracy in slow motion. It turns out that Sir John Filmer was right, and John Locke was wrong.

Of course, we value the numbers of life in this age because we trust that the numbers are not just a reflection of some normative truth but that they are accurate. Low inflation is a good thing so when the government comes out with numbers that say it is at or near the target of two percent, the experts cheer the rulers. This only makes sense if you think the government numbers are correct. The math of this age rests on people trusting the numbers of this age.

Is inflation really near three percent now? Did Joe Biden really get more votes than any human in the history of elections? Do most Americans back Ukraine? Was last Thursday the hottest day in the history of the planet? Despite the lack of evidence to support most of the numbers, most people seem to trust them. At the same time, most people do not trust the people issuing the numbers. For most of human history people would know to never trust anything from untrustworthy people.

That is the other novel thing about this age. Christianity has faded for most people as a foundation for moral claims. Something has to fill the void, so we have been flooded with new numbers to function as the authority. This explains why people trust the numbers while distrusting the people issuing the numbers. People are believing machines so when they stop believing in God, they will find something else. In this age people have come to trust the numbers as a last resort.

In a way though, this is the metric of the liberal society. It works when people can trust the people in official positions. They can trust those people because they trust the institutions to police the people in the institutions. Even in times when the office holders are distrusted, the people can still trust the numbers because they are viewed as the product of the institutions. As long as people still trust the numbers, the rulers are safe, despite the fact they do nothing but lie to us.

And he continues in another post:

There is a bigger issue that applies to all the numbers. Decades of lying about the numbers have made all of them suspect. The totally fake economic data pumped out in the Obama years sunk the credibility of the court wizards. When those people with impressive credentials put on their serious faces and said that taking money from you and giving some of it to your neighbor would grow the economy, even the most innumerate started to question the math.

It is not just the big stuff where lying has undermined the trust in the numbers that used to be the guideposts of society. Television ratings are obviously bogus or not as meaningful as claimed. If the people making the content cared about ratings, they would not have smeared their feces all over popular content. Ad makers would not have replaced most of the white people with nonwhites. They certainly would not have every white woman paired with a black guy.

Probably the most egregious offender of the numbers are the tech companies, who clearly fake all of their numbers. How many users are really on Twitter? No one knows but we know the official number is a lie. We can clearly see that the follower counts and impressions are fake. Before buying Twitter, Elon Musk made the rather obvious claim that the site was riddled with bots and fake accounts. Once the deal closed, he stopped talking about the bots and fake accounts.

There is more to the general fakery than the unreliability of the numbers. It is that it reflects a collapse in trust. When the government claims inflation is under control, but you keep seeing your expenses climb, you are reminded by the numbers that the people in charge cannot be trusted. When some new personality bursts on the scene claiming to have a huge audience, but no one you know heard of the guy until last week, you cannot help but wonder if it is a lie.

The numbers of life are not supposed to tell us what we ought to do, but to be a measure of what we are doing. If we cannot trust the numbers or the people issuing the numbers, then we cannot know what they are doing. We have no way of judging what is being told to us or if it is on the level. The only logical response is to assume the numbers are fake and the people issuing them are lying. A society with unreliable numbers is a society run by unreliable people.

Of course, this is most clear in politics. The most important numbers are the votes counted on election night. The logic of democracy is that everyone gets their say, then everyone votes and the side with the most votes wins. Along the way polling tells us how the various arguments and people are doing. If all of these numbers are fake, then what is the point? If the numbers at the soap box and the ballot box cannot be trusted, you are left with the numbers in the cartridge box.

Since the end of the Cold War, American society has travelled along an arc that started with a trust in the numbers and the people behind them to a place where no sane person trusts the numbers or the people behind them. That is probably why it feels like this pirate ship of a society called America is sailing into dangerous waters. Odds are just numbers, and the odds say that in a world without reliable numbers, the most likely outcome is the ship eventually sinks.

Jacques Ellul in The Technological Society (1954) criticized the tendency to focus on numbers at the expense of everything else. The commodification of human existence, driven by technological rationality, has led to a reduction of individuals and social relationships to mere statistics. This stripped complex human experiences of their qualitative, emotional, and cultural dimensions, prioritizing efficiency, productivity, and control at the expense of values and individual freedom. In such a system people are no longer seen as unique individuals with intrinsic worth but as components in a machine, whose value is determined solely by their output or their role within the system. The focus on quantification, while promoting rational decision-making undermines the richness and diversity of human life and thought. I will cover this book in a future post.

The elites were smart to keep Numbers Going Up during “COVID” (except for the initial panic), because it satiated the bourgeoisie who don’t care about anything else. It is a divide-and-conquer strategy: the elites seek to undermine all of society other than themselves, but they can’t do it at the same time without causing social unrest, so they will benefit one group over others (during fraudvirus, those invested in the stock market over the working class). I recommended people live beneath their means in this post and warned that the era of empty secular mass consumption is over here.

Conclusions

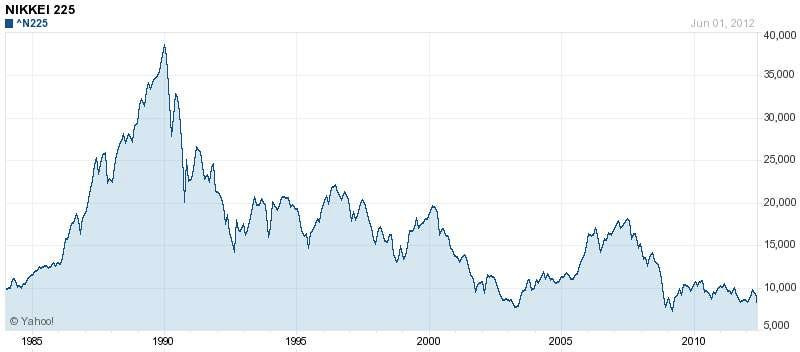

As I wrote in this post, looking at Japan’s example from the 1980s where our elites created and then popped a massive economic bubble in order to hand over control of their central bank to the Rothschilds, our elites have deliberately created the greatest stock market bubble of all time; they may pierce the bubble now or in the future, cause tremendous panic, and then offer a pre-designed dialectical CBDC solution which will result in the greatest loss of freedom in human history - and the boomers will eagerly take it. The Numbers Go Down could theoretically be a good thing to break people out of their spell and to cause emotional/psychic pain and a new focus on things other than Numbers, but I doubt that will happen as these people have no theoretical, intellectual, spiritual or emotional base prepared for such a change.

Benjamin Franklin once said: “Those who would give up essential Liberty to purchase a little temporary Safety deserve neither Liberty nor Safety.”

One may update this quote for the present moment: those who would give up a functioning Western society for easy profits deserve neither a functioning Western society nor profits.

Let’s end with this short video:

Thanks for reading.

From here: “Paul Warburg arranged the 1929 stock market crash; first he advised all member banks to get out of the stock market or sell it short on March 9, 1929, then on October 24 the Federal Reserve Bank suddenly increased the rediscount rate to 6%, thousands of orders hit the exchange to sell “at market”, and six days later the Federal Reserve Bank ordered the contraction of brokers’ loans in the amount of $2.3 million, the combination of which caused the crash. Congressman Louis T. McFadden stated “It was a carefully contrived occurrence. The international [central] bankers sought to bring about a condition of despair so that they might emerge as the rulers of us all."

From my post on FB - I don't spend a lot of time on composing those, but they do get my ideas across.

-----------

stock market is BS - any company and any nation that joins the stock market BS becomes a subject of external control. Aside from that, stock market is not a reflection of economy - it's a mechanism for creating illusions, which are being pushed via different narratives by the 'experts' in the field.

Most of the stockmarket is owned by the cabal. Even if a company were to stop selling all products for a year, cabal could keep the money in that stock and it wouldn't budge, no matter how dire the financial position of the company had become.

Looking at today's chart - it seems as if the cabal is pulling its money from the stock market. That will later be used to justify the crashing banks. That will later be used to justify crashing economy. That will later be used to justify unveiling the new digital 'solution'.

In that regard, I am reminded of the Iraq war fiasco. Cabal-owned NYT published a BS story about Iraq having WMDs with an actor pretending to have inside knowledge. That story was then used by the cabal-owned government officials (was it Cheney?) in order to justify starting the war in Iraq. It's a closed loop system - the actors, the script, all linked up - and it works as long as the pleb class buys it, which it does and will continue to buy for the foreseeable future.

I appreciate that you pointed out ..... "Tariffs - which is the official but false excuse for Numbers Go Down (the elites simply determine if or when to crash the market, as they did in 1929"

We've learned a lot in recent years about how fake and rigged is most everything under the sun, normally faked and rigged using our tax dollars. USAID was a nice recent window into how that all works. Yet somehow, in spite of all that, some people still believe that this regime, which rigs everything that is important and critical to it, would just leave the stock market to chance. They even admit out loud that it's rigged, using phrases like the Greenspan Put or the Powell Put. They'll spend all day on CNBC arguing about what the Fed will or won't do, but in the next breath tell you it's a "free market."

If the markets were what they are claimed to be, and not rigged, and full of rational actors etc., then I submit to you that the tariff announcement would not have caused this sharp of an immediate drop. It wouldn't be good times in the market either, but it wouldn't be this. The present narrative is a little too neat and convenient. Kind of reminds me of the early days of the plandemic.

I have zero sympathy for anyone who was heavily invested in what was clearly, obviously, blatantly a bubblicious market. (The leading stocks had P/Es in the 50s! Higher!) They could only have been so on the basis of greed and/or dogma ("never sell!", "the market always goes up over time!"). Funny how such "convictions" are lost inside of a week.