From Revolution to Corruption: The Cryptocurrency Scam and the Future of Inflationary Bailouts

How a Promising Technology Became a Tool for Elites and Financial Manipulation

This post criticizes cryptocurrency as a negative reflection of the world’s increasing corruption and material “solidification”. It outlines three increasingly subtle methods of analyzing the space: first, as revolutionary technology; second, as a fraud-ridden space, notably with Tether; and third, as a controlled system used by elites to test technologies for central bank digital currencies. It argues that the crypto fraud will eventually be offloaded onto the public, leading to even higher inflation as the West shifts toward a more controlled, manipulative system that consolidates power and erodes freedom. It is a follow up to a 2023 post criticizing crypto.

In the entertaining and thought-provoking short story The Minority Report (1956) by Philip K. Dick - who’s mind-expansive, gnostic-leaning short stories I loved growing up and which I recommend1 - the protagonist, John Anderton, works in a law enforcement role within a "precrime" unit. This unit relies on three psychics known as "precogs" who predict crimes before they happen with great accuracy. Using their predictions, the police arrest criminals before they commit the offense. However, when the precogs foresee that Anderton himself will commit a murder, he is shocked and goes on the run, with his former colleagues following closely in pursuit. (Spoiler alert) In the end, Anderton discovers that the precogs were split in their predictions: two predicted he would commit the murder, while one dissenting precog believed he would not. Anderton tracks down the dissenting precog’s report, which becomes crucial to clearing his name. The decent movie adaptation (2002) introduces a debate about free will versus fate, ultimately concluding that free will can alter the future.

(As an aside, I miss the era of films before smartphones became ubiquitous around 2012, when many movies began to lose their quality. The rise of smartphones marked a new epoch per , in a way similar to the predictions of the Mayan calendar - transforming society as we knew it.)

The story’s ending, in my opinion, is far superior to the film’s. In the short story, the precogs’ predictions are not just about Anderton’s actions but also considers his knowledge of those predictions. This nuance is largely ignored in the movie. Here’s how the story’s predictions worked:

The first precog predicted that Anderton would commit the murder.

The second precog predicted that Anderton would be aware of the first precog’s prediction and would decide against committing the murder.

The third precog predicted that Anderton would learn about the first two predictions and, realizing the paradox, would choose to commit the murder anyway.

Thus, there was a 2-1 split in favor of Anderton committing the murder, but each precog’s reasoning was different. When Anderton became aware of this, he chose to follow the third precog’s prediction (although he could have changed his mind), reinforcing the concept of free will in light of knowing the future. This presents an interesting twist: free will only exists when one is aware of the predictions ahead of time. It’s a subtle but powerful commentary on choice and destiny.

The Levels of Cryptocurrency Analysis

In many ways, the situation in The Minority Report mirrors the paradoxes we face in understanding cryptocurrency. Just as the precogs predict an inevitable but conflicting future, we too are confronted with conflicting, paradoxical truths about crypto - its potential for revolutionary change, its susceptibility to corruption, and the realization that it may be controlled by forces beyond the public’s understanding. The truth depends on the level of understanding and perspective one brings to it. Just as Anderton is faced with differing predictions about his future, we are confronted with three distinct narratives about cryptocurrency:

Cryptocurrency as Revolutionary Technology: Cryptocurrency, with its blockchain technology, offers a new way of transacting that cuts out intermediaries like banks and governments. The transactions are private, verifiable, and secure. Unlike gold or silver, cryptocurrencies solve the logistical issues of storage, transfer, and counterfeit prevention. Julian Assange, for example, recommended cryptocurrency to Google’s executive chairman and lizard-man Eric Schmidt as early as 2011, as recounted in the book When Google Met WikiLeaks, after WikiLeaks found itself cut off from the financial system.

Cryptocurrency as Fundamentally Corrupted and Controlled: I have previously discussed how the entire crypto space has been corrupted by Tether. This $100 billion operation, run by known fraudsters, has never undergone a proper audit, and there is strong evidence suggesting that it has artificially inflated the crypto market by printing vast amounts of funds out of thin air and buying digital coins with them. The daily trading volume of Tether is greater than the trading volume of the top ten coins combined. The Tether scam, which was suspected as early as 2017, raises doubts about the legitimacy of the entire cryptocurrency ecosystem. Governments, I believe, could easily crash the market by targeting Tether or by shutting down fiat on/offramps like Coinbase. I felt uneasy about investing in crypto for these reasons - why would governments allow a viable alternative to fiat currency to flourish, especially when crypto is often used in illicit activities?

discusses this a bit in this comment. Bitfinexed on Twitter has also focused on the details of Tether with sustained energy for years.2Cryptocurrency as a Positive Investment Because It’s Corrupted: This perspective sees the crypto corruption as a plus, with the CIA and NSA backing Tether to prevent its collapse (the Russian term for this kind of protection is a krisha). In this manner the elites felt comfortable with growing the space because they control it - they could pump or crash the market at their leisure. By allowing the crypto space to grow, these agencies were able to test blockchain technology in preparation for upcoming Central Bank Digital Currencies (CBDCs), which are poised to result in the greatest loss of personal freedom in history, discussed previously here. Crypto has also allowed these elites to enrich themselves and bolster CIA black operations. With research into CBDCs basically finished and ready for rollout - either gradually (via Musk/Trump $5,000 payments to people via CBDC, perhaps?) or rapidly as a dialectical solution to a contrived financial crisis - the primary objective of privately owned crypto has already been accomplished. It seems the exit strategy of our elites will be to offload the massive cost of this privately owned crypto Ponzi scheme onto the public through government-backed cryptocurrency reserves and other bailouts. This third stage is far more cynical and disillusioned than the second, which still held some belief in the rule of law and the ability of institutions to control fraud. I’m convinced that if the elites hadn't been able to dominate and control the crypto space, it would have collapsed much sooner.

Thus, these three levels of understanding - cryptocurrency as worth investing in, as not worth investing in, and ultimately worth investing in again - mirror the logic of the precogs in The Minority Report: the initial belief in cryptocurrency as a revolution, followed by a realization of its corruption, and ultimately an acceptance of it because the ecosystem is controlled by those in power. Two out of three, investment wins and those who did early got amazingly rich from it! But as I wrote in a Note, I know at least three young-ish cryptocurrency investors who are worth over $100 million from their “investments” and all three are idiots stuck at the first stage. When I talked to them early about what a flimsy scam Tether was all three stuck their heads in the sand and ignored it. As I wrote:

So from my perspective these abject, shallow, utter morons have fallen ass-backwards into immense wealth, beneficiaries of a long-term, giant scam that they have no knowledge of, while I stayed out of it because I thought something deeper was afoot. As the famous saying goes, "Man plans, God laughs" and these 100 IQ scammers are now driving around in Maseratis while I eat the equivalent of dog food.

Oh well.

But the story of cryptocurrency doesn't exist in a vacuum. Its rise and fall are part of a broader societal transformation - one that encompasses everything from how we interact with technology to how political power operates in the digital age. The advent of smartphones and social media has not only reshaped our daily lives but also set the stage for the next phase of digital control. In many ways, the crypto space serves as a microcosm of this larger shift, where power, technology, and society intertwine in ways that were once unimaginable.

The Pivot to Dump Crypto Onto the Public as an Exit Strategy

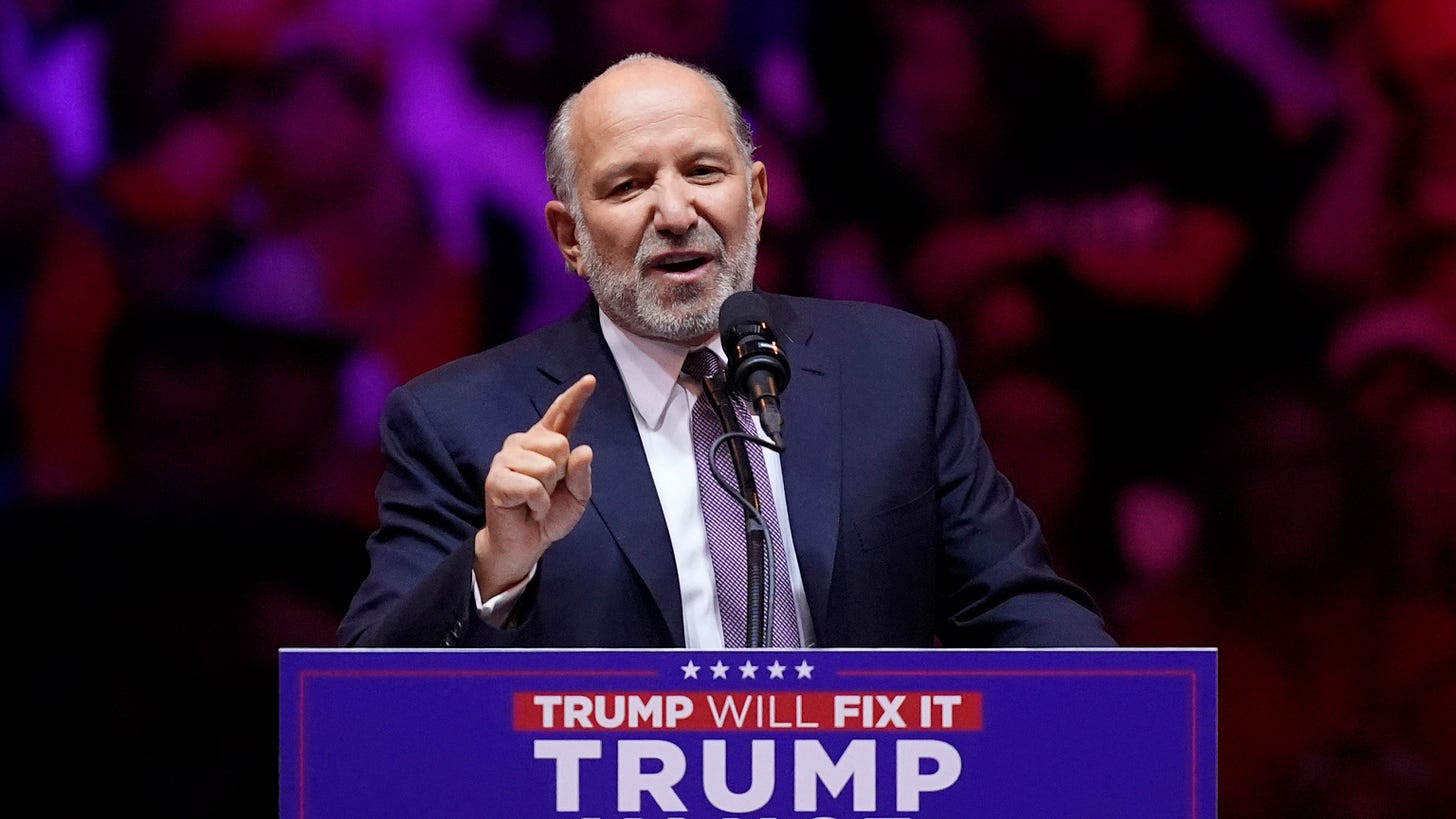

Cryptocurrency is at the stage now of in-your-face violent, intense fraud. The cryptocurrency industry backed Trump to win the election and has heavily capitalized on it; investigations into the endless number of crypto scams have been shut down, Howard Lutnick - an arch-criminal heavily involved in the Tether scam - is now the Secretary of Commerce, the investigation into corrupt Coinbase has been shut down after they donated tens of millions to his campaign (and the CEO’s sister now works for DOGE), the investigation into also arch-criminal Justin Sun has been shut down after his enormous contributions to Trump, Trump himself has benefitted from the enormously in-your-face corrupt TRUMPCOIN (launched two days before his inauguration where he made billions of dollars from it!) and MELANIACOIN, and each time crypto starts falling in price a new narrative is released to re-pump the price (such as Trump pledging to introduce a governmental crypto reserve). Corporate transparency has also been banished by executive fiat. All while the IRS is being cut in half (something I am not opposed to in theory, but when combined with the above it’s clearly being done to facilitate fraud).

There’s also enormous insider trading going on — the day before Trump introduced the governmental crypto reserve idea someone bought $200 million of Bitcoin and Ethereum on 50x leverage and made $1.5 billion of profit in a single day. Someone sent me the below image from a Telegram chat or elsewhere, I cannot speak to it’s origin but the bet must be from someone deeply connected within the administration.

noted a smaller (still seven figures) but similar trade at 50x leverage here. This is so wrong and gross. And we’re only two months into this administration! Imagine where we will be as a country with four years of this (or longer if Vance wins in 2028) - it boggles the mind.Anyway, I’m too disturbed by what’s unfolding in this space to keep focusing on the details. Cryptadamus is doing an excellent job of exposing the staggering extent of in-your-face corruption so check out his Substack Notes for more information. The wolves are in the henhouse now, and there's no longer any fear of prosecution from the authorities. The CIA/NSA-backed Tether scam will eventually be offloaded onto the public who will bear the cost through inflation. CBDCs are ready to roll out, and a woke, sinister AI is being fine-tuned to usher in a digital panopticon, where everyone’s behavior will be micromanaged on an individual level. The head of the Bank for International Settlements, Agustin Carstens, brags about what is coming soon with their micromanaged CBDC control grid and dramatically decreasing quality of life for most:

One can see these pigs at the trough rushing to get rich so that they are on the ruling end of this rapidly progression transition to neoliberal feudalism.

Conclusion

Despite all this, I’m still not invested in crypto. I do, however, ironically have a tip jar set up with it because I don’t fully trust Stripe as a payment processor. Even though it’s probably still a decent investment bet, considering the intense push to legalize all the criminal activity and shift the costs onto the public, I just don’t feel comfortable contributing to this mess at this point. There’s always the possibility of a rug pull — who knows? Regardless, cryptocurrency is definitely not an investment in the traditional sense; it’s just a wager on more corruption and fraud.

Technology, like anything else, is a double-edged sword. What appears beneficial now will have negative repercussions down the road. For example, Rome’s destruction of its arch-enemy Carthage ushered in an age of unprecedented decadence and laid the groundwork for Roman dictatorships. Similarly, the benefits of technology — from social media to search engines to artificial intelligence to cryptocurrency — are evident now, but the drawbacks of technological advancement will only become fully manifest in future generations, as digital slavery becomes a horrifying reality. While the elites have been planning this outcome for centuries, the masses are focused on short-term survival, unaware of the dangers ahead. Humanity is a violent, bloodthirsty species, and the decades of prosperity since World War II have accumulated a psychic toll that will soon be cashed in by the Demiurge, affecting humanity in ways deeper, more negative, and more profound than ever before.

Ultimately, this world continues its descent into the “solidification” of the material realm as described by René Guénon with his conception of the Kali Yuga — which increasingly seems to be culminating in the rise of an Anti-Christ figure. The failure of this scheme, after worse horrors than we can possibly imagine, may then give way to the Age of Aquarius and a new paradigm.

Thanks for reading.

PS: While I have not enabled paid subscriptions at this time, I am going to try out crypto if you found my work helpful and would like to donate (yes, I recognize the irony of this in this post). Posts are and will remain free. This is an experiment and is subject to further changes:

Bitcoin: bc1qh6cdaagqwcmp7ctqt9gdj6y6xjr88a7pz7fgpg

Ethereum: 0x30DB893613D032cdcE3B4F6De86aF921A236a7C3

Monero: 43CX9B3nfmJcmrD624pTq86gNRFeEk2eMMWjWtMy59afX8Szrxt88VkXRw6ez3LKWXcLtZxWjGgrk9Kecv9xvqsvGJcGrVa

But the people who listened to him ended up poor. He also never revised his views to the third level, which led me to believe he might be controlled; when I asked him some basic questions about his positions years ago on Twitter he immediately banned me.

Excellent analysis. Maybe the State has gotten so powerful it's just manipulating everything now - Gold prices are held down, dollar is inflated, Bitcoin is inflated - All of them could be useful as a store of value or as money but the State has ruined them.

Hilarious that Trump did not one, but two, pump n' dumps and no one cares. Hawk Tuah does one and she's finished.

I'm in Precog group three. Is Bitcoin inflated? Yep. Will it keep getting inflated? Yep. Probably for much, much longer than we'd like to think. Look at stocks - They've been inflated, and the means of inflation, for six or seven decades now. Every penny spent on Bitcoin should be offset by the same in gold/silver though. IMO.

The other nasty element of crypto is the fact that the mining essentially just makes the coin itself a store of wasted energy devoid of any objective value. If everyone stops believing in crypto it turns back into nothing more than entropy. It's interesting to note that the liberals constantly screaming about all those carbon emissions and how everyone should be made to live like a Bangladeshi garbage scavenger aren't barking their heads off about this.